Discounts and rewards

You can offset some of the fees you pay, or earn even more, by receiving rewards based on trading activity. Rewards can be funded by anyone, and can be in any asset. You can see what rewards are currently available on vega.xyz ↗.

Referral program

You can earn a commission for referring new users when a referral program is enabled. New users get a discount on their fees, while whoever refers them gets a cut of their referees’ trading fees. How much commission the referrer receives is increased if they have VEGA associated to their public key.

Get benefits for referring, or being referred. In the referrals section of Console, you can:

- Create a code to refer others

- Enter a code you've been given

The referral program only exists if it's been enabled through a governance proposal. Once it's enabled, both the requirements and benefits can also be replaced with a new program, also using a governance proposal.

You can see what the current program offers by checking the Referrals page on Console, or the referral program API.

Fee discounts based on trading volume

Traders can get discounts on their fees when there's an active volume discount program on the network. The higher your volume of aggressive trades on a market, the greater the discount you can receive.

The size of the discount, generally speaking, depends on the volume of your taker trades over a set window of time. You can get access to different levels of discounts when your trading volume is higher.

All of the details for the volume discount program are proposed and accepted through governance. You can the current program by checking the volume discount program API.

Trading rewards

Market participants can also receive rewards for their trading activity, liquidity provision, and for proposing actively traded markets.

Traders can receive bonuses for placing market and/or limit orders that are filled, and keeping positions open.

Liquidity providers can receive rewards on top of the fees they earn for placing orders that are likely to match.

Market proposers can receive rewards for proposing markets that draw in trading volume.

Your reward earnings can grow if you have an activity streak and/or keep earned rewards in your rewards account.

See what rewards are currently available on vega.xyz ↗.

Rewards are independent from fees, which are paid to validators, liquidity providers, and price makers on each trade.

How rewards are paid

Rewards that you earn are paid into a per-asset vesting rewards account. They may be locked for a time, if there's a lock period set. Each epoch, a percentage of the locked rewards begin vesting. Once they're vested, they are moved into a vested rewards account. From there, they can be redeemed by transferring them into your general account and withdrawn.

The lock period is defined in the transfer that funded the reward. Use the transfers API to see the lock periods.

Once they unlock, a proportion of the rewards move into the vested account each epoch: 🔗current rate: 25%. That percentage can be higher if you have an activity streak going.

Reward hoarder bonus

Leaving your reward earnings in your vested account will increase your share of the trading rewards you've accrued. How much extra you get depends on your total rewards balance, whether it's locked, vesting, or vested.

You can see the current reward hoarder bonus requirements and benefits on the block explorer ↗, or querying the network parameters API for the rewards.vesting.benefitTiers network parameter.

These tiers are set through network parameters, and thus can be changed through governance.

Activity streak

Traders that keep up an activity streak, either by placing trades or keeping a position open over several epochs, can receive a greater share of rewards and their locked reward proceeds will be available sooner.

Keeping up your activity gives you access to greater benefits as your streak grows. Activity streaks are measured in epochs.

You need a minimum trade volume of 🔗2500 or a minimum open volume of 🔗500 (both expressed in quantum) to be considered active.

If you go inactive for more than 🔗3 epochs, you will lose your streak.

You can see the current activity streak requirements and benefits on the block explorer ↗, or querying the network parameters API for the rewards.activityStreak.benefitTiers network parameter.

The details for activity streaks are set through network parameters, and thus can be changed through governance.

Setting rewards

Rewards can be set up by anyone to incentivise certain trading behaviours they want to see on a market (or markets).

Trading rewards can be defined by the following things:

- Type of activity to be rewarded (and how it's measured)

- An amount to reward

- How long a reward is offered

- How the reward is distributed to those eligible, pro-rata or by rank

- How many epochs a trader's activity is evaluated

Extra rewards for validators can also be set up. Learn more about them on the validator scores and rewards page.

Example: Evaluating reward performance over time

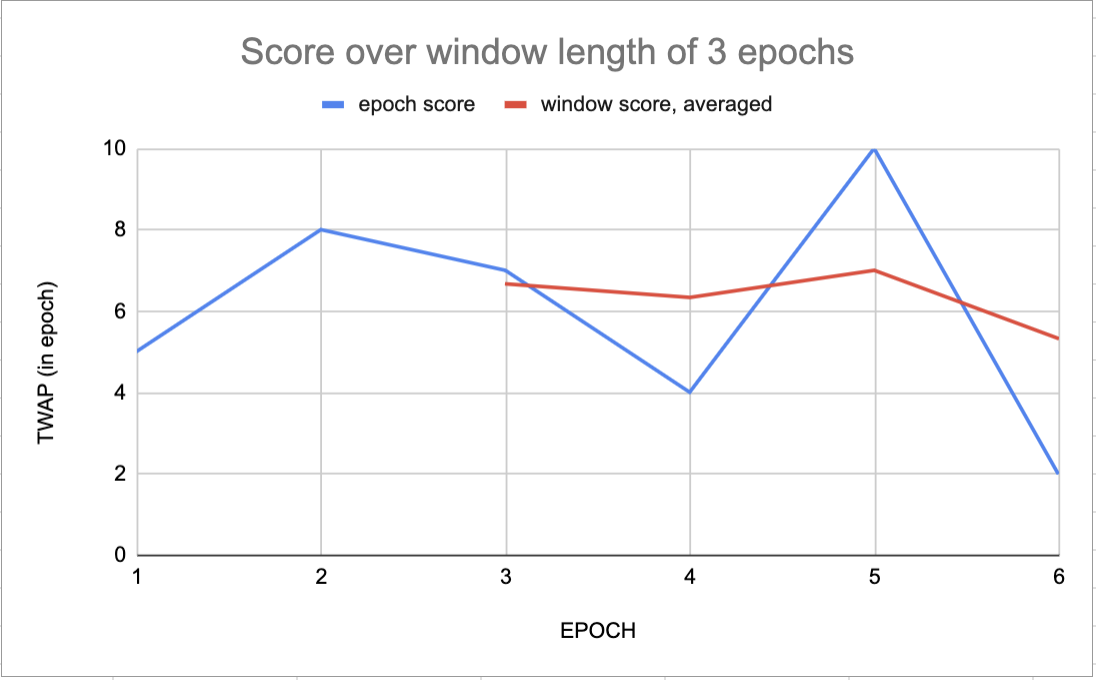

Some rewards measure trader activity over a number of epochs (set per reward). The image below shows how an average of your scores is taken across the window, i.e., the number of epochs chosen for measurement.

- Concept: How to fund rewards: Get the high-level overview, below.

- Tutorial: Set up a reward transfer: Choose an activity to reward and set up a one-off or recurring transfer to fund it.

How rewards are scaled

Since rewards can only be provided if they're funded, the recurring transfer that's used to fund those rewards also includes details on how the final reward amount is calculated.

Pro-rata: A participant's reward is scaled based on their score.

Rank: A participant's reward is scaled based on where their score lands on the rank table. The rank table determines a rank group, for example 1-8, and what ratio of the reward amount that group would receive.

If you have multipliers from the activity streak and/or the reward hoarder bonus, your share of the reward grows in proportion to those multipliers.

Available trading rewards

As rewards are distributed based on certain criteria, they need to be defined and measured. Each reward dispatch metric is calculated per party, once at the end of each epoch.

Rewards can be set up to pay those who receive fees (functioning like a 'bonus'), or those who create markets.

Choosing a dispatch metric is a matter of transferring assets to the relevant account type, which then contributes to the reward pool for the metric.

Fee-based rewards

Fee-based rewards are designed to incentivise trading volume on a given market, and are dependent on how much a participant pays in fees.

Targets for rewards can be set based on one of three categories:

- Sum of the maker fees a party paid

- Sum of the maker fees a party received

- Sum of liquidity fees a party received

Each is calculated per market, and assessed per party, relative to the total sum of fees across all parties for the given market.

When incentivising based on fees paid/received, any participant who, for example, places a market order that is filled, will receive a proportion of the reward amount available.

Example: Traders on Market X are eligible for rewards based on maker fees paid.

Party A, trading on Market X, has paid $100 in maker fees in one epoch.

The total maker fees paid by all parties in that market is $10,000.

Party A would receive $100 / $10,000 = 1% of the rewards for that epoch.

Largest traders by position size

The largest traders by position size category rewards traders with consistenly larger positions that rank higher in the standings than other traders, as long as they can keep the positions open.

It measures a trader's time-weighted average position over a set number of epochs to determine how long each trader is able to manage a position that's larger than the positions of other traders, without being closed out. It's also known as the "average position metric".

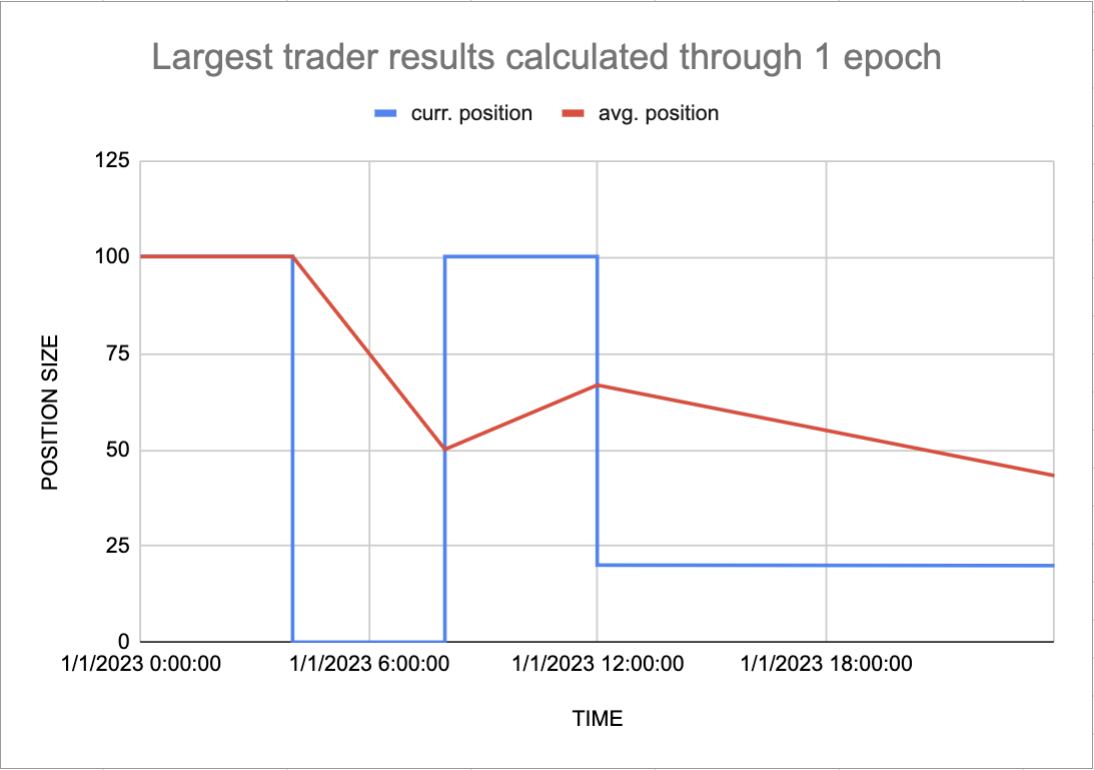

Example of largest traders by position size

The image below shows how the largest traders by positions size is calculated in a single 24-hour epoch.

Actions of the example trader in the image above over 24 hours:

- 00:00 - trader opens a position

- 04:00 - trader closes their position, their average position starts to decrease

- 08:00 - trader reopens their position, their average position starts to increase

- 12:00 - trader reduces their position, their average position starts to decrease

Most profitable traders

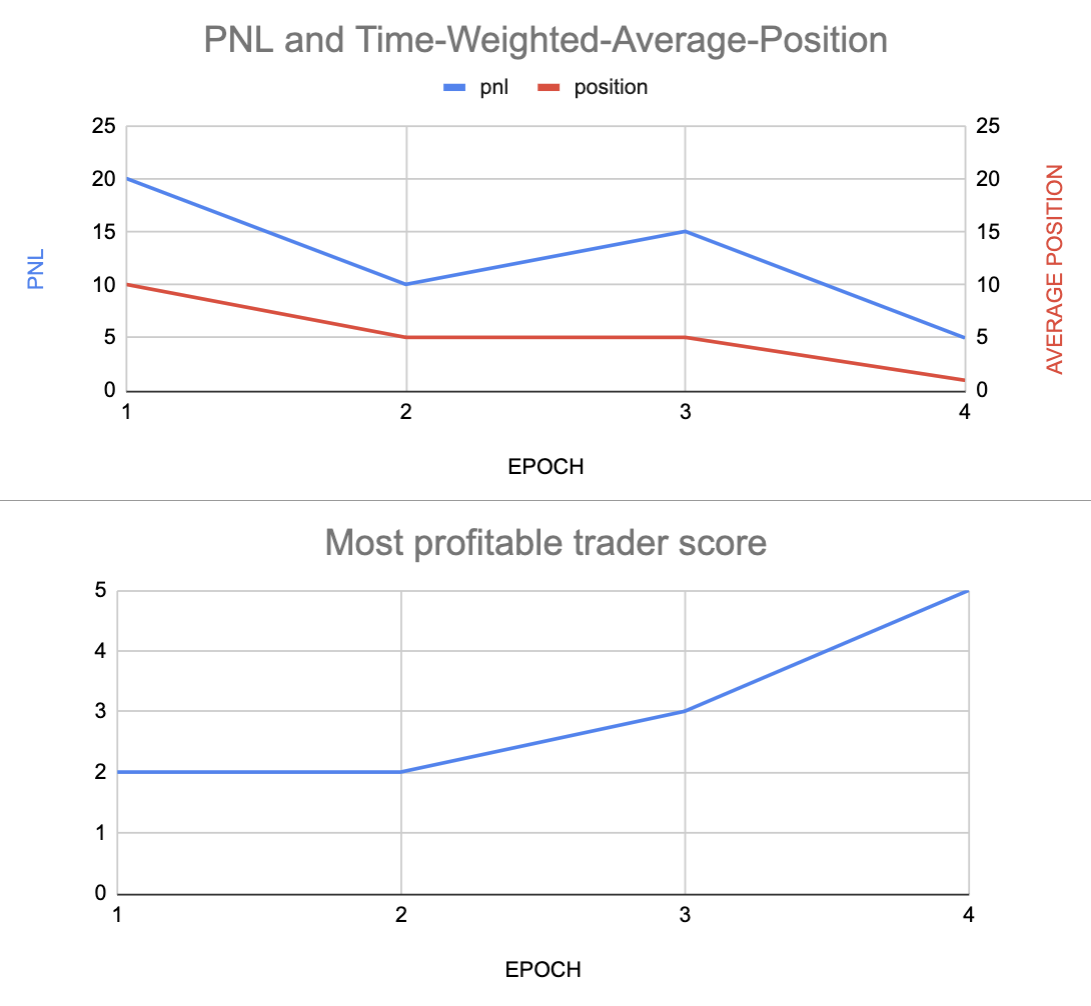

The most profitable traders category rewards high profit in relation to traders' position sizes. A trader's highest relative profit is taken from each epoch in the reward window, and averaged out. Those who have higher relative profits rank better in the standings. It's also known as the "relative return metric".

Example of most profitable traders

The image below shows how the most profitable trader's score is calculated across epochs. A trader with a large amount of capital will have as much chance of winning as a trader with a smaller amount.

Most consistently profitable traders

The most consistently profitable traders category rewards traders with the least amount of variance in their returns while they had a position open on a market in the rewards window. Traders who have similar amount of profit across the epochs, rather than spikes and dips, rank higher in the standings.

This is measured by taking the sum of each trader's mark to market gains and losses, both realised and unrealised, and includes funding gains and losses if trades are on a perpetuals market. It's also known as the "returns volatility metric".

Market creation rewards

The market creation reward dispatch metric is designed to incentivise creating markets that attract good trading volume. Rewards are awarded to the proposers of any markets that meet a certain total trade value.

The threshold for what counts as 'enough' trading volume is a formula that takes into account the value of the network parameter 🔗rewards.marketCreationQuantumMultiple: 50000000, as well as the settlement asset's quantum to assess the market's size.

An asset's quantum is defined as an approximation of the smallest 'meaningful' amount of that asset, generally expecting it to be the quantity of the asset valued at approximately the value of 1 USD. An asset's quantum is set in the governance proposal that enabled the asset for use on Vega.

Example:

In a given epoch, 4 markets all reach $10,000 total trade value, which is the threshold value set in the network parameter.

The proposers of each of those markets qualify for 25% of the market creation reward for that epoch.

Spec: Rewards ↗: See the full set of calculations that go into the market creation reward.

Reward examples

In the section below are descriptions of potential reward scenarios, including the scopes and dispatch metrics used.

See reward examples

An early liquidity provider who supports the ETH / USDT 1Y Future market wants to encourage people to trade on the market, and as an early adopter of Vega wants to incentivise people to hold VEGA too. That provider would transfer their chosen amount of funds to the relevant reward pool.

Reward Pool 1:

- Reward asset = VEGA

- Market in scope = ETH / USDT 1Y Future (defined by Market ID)

- Reward metric type = Maker fees paid

This reward pool will transfer VEGA to anyone acting as a price taker and therefore paying maker fees on the market.

They may later decide that they have successfully driven so much volume that they would like to encourage more liquidity in the market to help supplement their own. In this case they could fund another reward pool.

Reward Pool 2:

- Reward asset = VEGA

- Market in scope = ETH / USDT 1Y Future

- Reward metric type = Liquidity fees

This will provide an additional incentive for LPs to commit liquidity, since in addition to the liquidity fees they would already receive (in USDT, the settlement asset of the market), they would also receive VEGA proportional to the share of liquidity fees they received for the market.

Finally, they may decide that they also want to provide a reward in the market’s settlement asset rather than solely reward in VEGA. Therefore they transfer funds to an additional reward pool.

Reward pool 3:

- Reward asset = USDT

- Market in scope = ETH / USDT 1Y Future

- Reward metric type = Maker fees paid

Now, any user that has been a price taker in this market will receive two reward payments at the end of the epoch, once in VEGA and one in USDT, with both proportional to their overall share of maker fees paid in the market.

How to fund rewards

Trading rewards are all on-chain, and funded when users transfer assets to the reward pool for a particular reward, based on the asset used to pay the reward.

Choosing a reward to fund is a matter of transferring assets to the specific account type.

To fund a single reward pool over multiple epochs, set up a recurring transfer to a single reward pool that will keep topping up the reward pool for each epoch, as long as there are funds available in the party's general account.

Another option is to regularly top up multiple reward pools across multiple markets, for a single metric and reward asset, by setting up a recurring transfer to multiple reward pools.

At the end of each epoch, all reward pools are emptied and their funds allocated to users proportionally based on the specifics for each reward.

Anyone can finance rewards. If a reward pool doesn't have assets in it, then no rewards will be paid.

When setting up a reward, the following information determines that your funds go into the correct reward pool:

- Reward asset: The asset in which the rewards will be paid

- Market in scope: The Market ID of the market for which rewards will be calculated

- Reward metric type: The metric type to be used to calculate the reward

Note: a multiple market recurring transfer can only be used for markets that settle in the same asset, since otherwise they cannot be compared.

Funding examples

In the dropdown below you can read through examples of how funding reward pools works.

See funding examples

A participant wants to incentivise trading on three new markets, all of which have the same settlement asset. They can create a transfer that will top up the reward pools for those markets that accept VEGA as a reward and that calculate based on the ‘maker fees paid’ metric.

- Reward Pool 1: Reward Asset = VEGA | Market ID = A | Metric Type = Maker fees paid

- Reward Pool 2: Reward Asset = VEGA | Market ID = B | Metric Type = Maker fees paid

- Reward Pool 3: Reward Asset = VEGA | Market ID = C | Metric Type = Maker fees paid

All 3 markets settle in USDT. The rewards will be split to each market proportionally based on how much was paid out in maker fees for each market, and then each market’s pool will be split proportionally between users who paid maker fees in each defined market.

In the current epoch:

- Market A has 200 USDT in maker fees paid

- Market B has 100 USDT in maker fees paid

- Market C has 700 USDT in maker fees paid

The user sets up a recurring transfer for 10,000 VEGA into the three reward pools above.

- Reward Pool 1 share: 200 / (200 + 100 + 700) = 0.2 x 10,000 = 2,000 VEGA

- Reward Pool 2 share: 100 / (200 + 100 + 700) = 0.1 x 10,000 = 1,000 VEGA

- Reward Pool 3 share: 700 / (200 + 100 + 700) = 0.7 x 10,000 = 7,000 VEGA

Each reward pool is then distributed to individual parties as described in the Reward pools section.